Our

business

HSI

We are one of the largest alternative investment fund managers in Latin America, firmly aligned with our investors’ interests. We ensure active management with a focus on growth and returns.

We have a demonstrated track record of accessing ample investment within our investment theses. This is enabled by our fundamentals-driven and assertive analysis, agility in negotiations, and creativity in developing innovative solutions, always with an eye towards generating consistent returns.

Listed Funds

HSI MALLS

(HSML11)

Largest IPO to date of a shopping center fund

HSI Logística

(HSLG11)

Logistics warehouses

100% last-mile facilities

HSI Renda Imobiliária (HSRE11)

Hybrid

Various real estate asset types

HSI Ativos Financeiros (HSAF11)

Real estate receivables

Active managment and proprietary deal flow

Real Estate

Private Equity

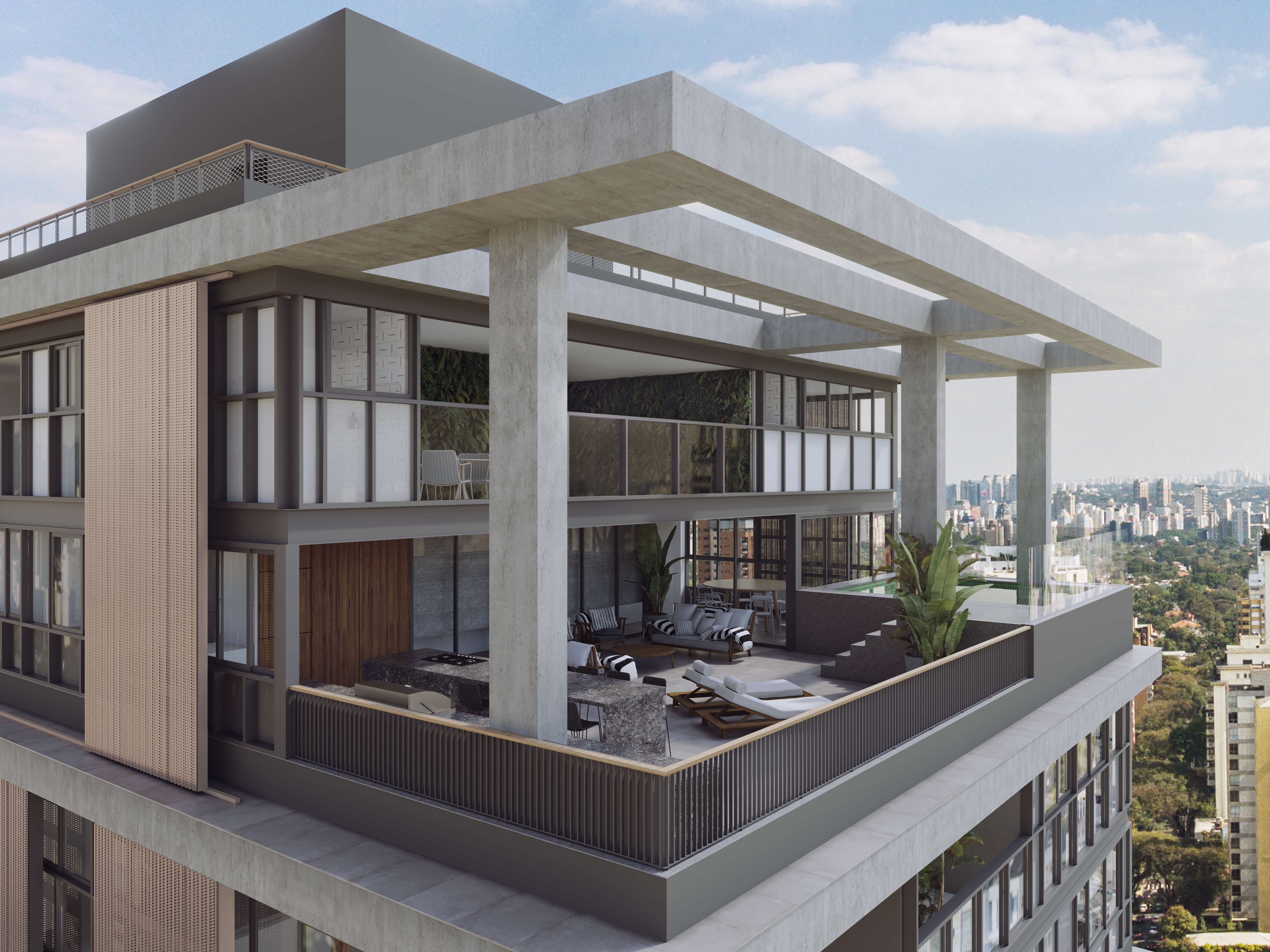

HSI is the market reference in Brazil for real estate private equity, with deep expertise in all the major asset classes such as office, logistics, retail, hospitality, and residential. HSI Real Estate Private Equity is recognized as one of leading managers in this space in Latin America, having invested global institutional capital for the past 17 years.

BRL

4.5

billion

AUM

BRL

9.7

billion

capital invested

BRL

9.0

billion

returned to investors

Over 2,5 million sqm

developed

Over 2,8 million sqm

acquired

Development capabilities

Shopping

Centers

Over 830,000 sqm

Office

Over 410,000 sqm

Logistics

Over 340,000 sqm

Residential

Over 155,000 sqm

Hospitality

Over 74,000 sqm

Special

Opportunities

HSI Special Opportunities offers bespoke capital solutions for companies. We implant governance regimes focused on establishing operational and financial discipline.

BRL

2.6

billion

AUM

BRL

2.8

billion

Returned to investors

BRL

3.5

billion

Capital invested

Listed

Funds

HSI began its activities in the real estate market through private equity funds supported by global institutional investors, finding a successful formula through the diligent application of its governance principles and active management. With the maturation of the domestic market, in 2019 we launched a practice focused on Listed Funds, extending the management model that made HSI a global reference to Brazilian retail investors.

BRL

4.8

billion

AUM

Over

220,000

Investors

Over

774,000

sqm

GLA under management

Ativos Financeiros

HSI Ativos Financeiros invests in real estate debt securities, combining our expertise in credit and real estate finance.

Through active management, fundamentals-driven analysis, comprehensive due diligence, and constant portfolio monitoring, we seek to continuously generate value for our investors.

BRL

700

million

AUM

Over

10,000

Investors

Alqia

Alqia is a retail operator that currently manages a portfolio of 11 shopping centers held over various HSI funds, both listed and private equity. Assets range in stage of maturation and total 390,000 sqm GLA.

Investments are strategically diversified, both geographically and by consumer profile.

11 shopping centers

under management

116 million

annual foot traffic

BRL 4.8 billion

annual sales*

through December 2023*

Portfolio

Highlights